Chain Abstraction in 2024: A Year in Review - by Omni, Particle, and LiFi

Introduction: The Growing Complexity of Web3

The Internet of blockchains can hardly be called a "Web" if users must constantly manage direct interactions with countless distinct chains. Thousands of chains create a maze of wallets, balances, and identities, making the experience for both users and developers increasingly overwhelming.

List of tracked chains on DeFiLlama (300+).

For Web3 to be a true “Web", we need to transform the manual processes of interacting across chains into a unified experience. This is what’s known as chain abstraction.

The Rise of Chain Abstraction in 2024

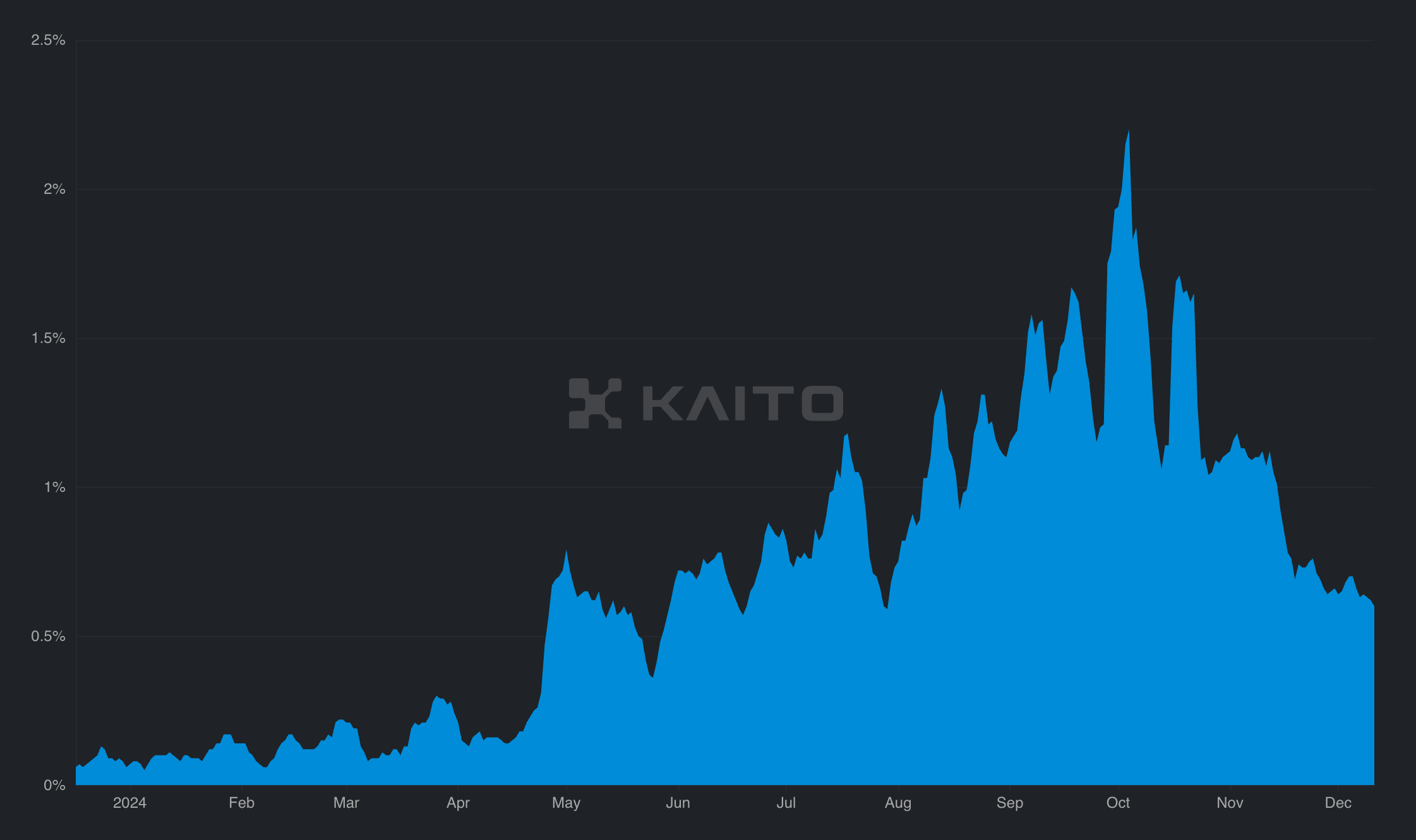

Just a year ago, chain abstraction was little more than a buzzword with no tangible backing. Over the course of 2024, however, it has evolved into one of the most significant infrastructure narratives in Web3. The community has reached a collective realization: solving fragmentation is critical to the future of crypto's adoption.

Chain Abstraction Mindshare in 2024. Source: Kaito

As 2024 draws to a close, the hype around chain abstraction has started to materialize. We are at a pivotal moment, with much of the groundwork laid and significant room for further progress in 2025. This report reflects on the strides made in 2024, the current state of the industry, and the opportunities and challenges that lie ahead.

Market Trends

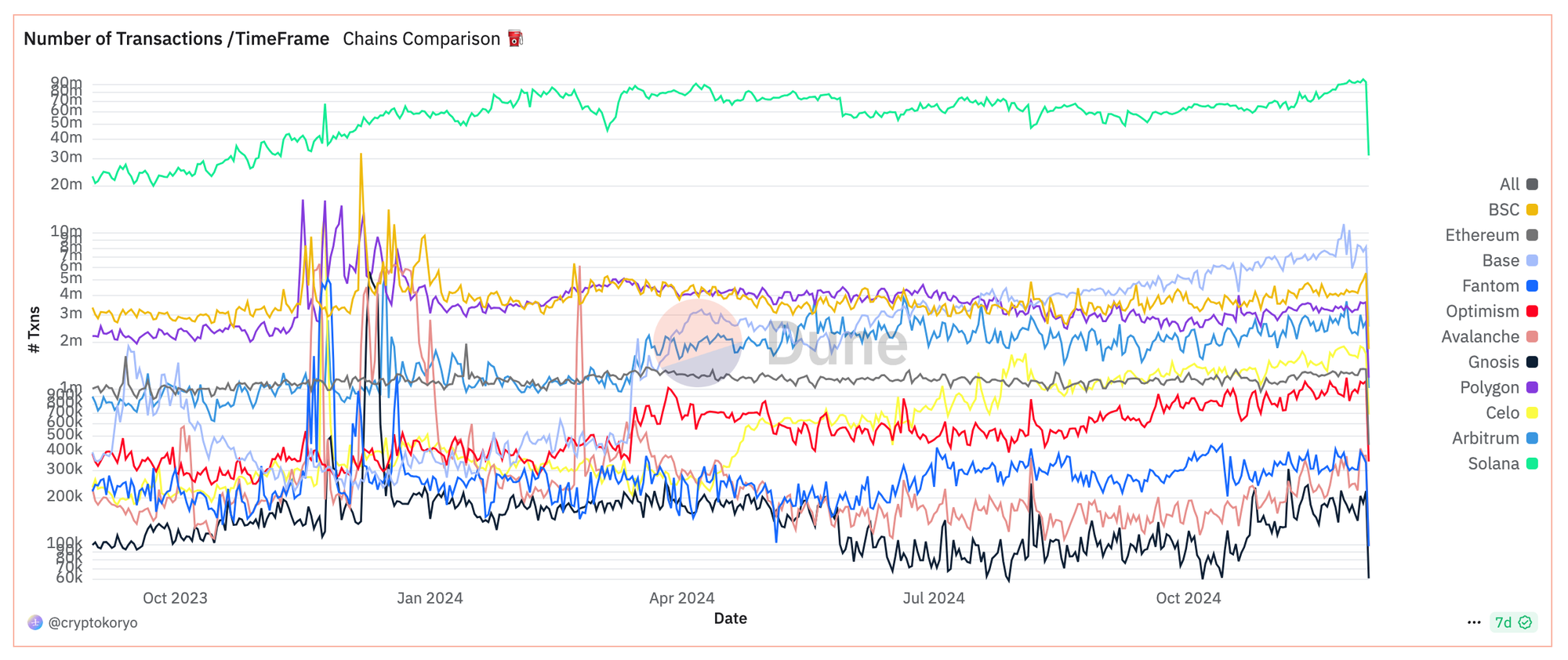

Since January 2024, more than 119 new chains have launched in the Ethereum ecosystem alone. These new chains have further siloed users and their activities. Yes, we're successfully scaling, but at what cost?

Average daily transactions for the most popular chains. As highlighted by Particle, most growth efforts have fragmented a static user base between disparate networks. Source: Dune

A simple yet transformative perspective emerged early in the year: what if users were chain-agnostic? What if their balances could seamlessly operate across any application, on any chain, without manually bridging and coordinating liquidity? This vision of chain abstraction quickly gained traction and attention across the industry.

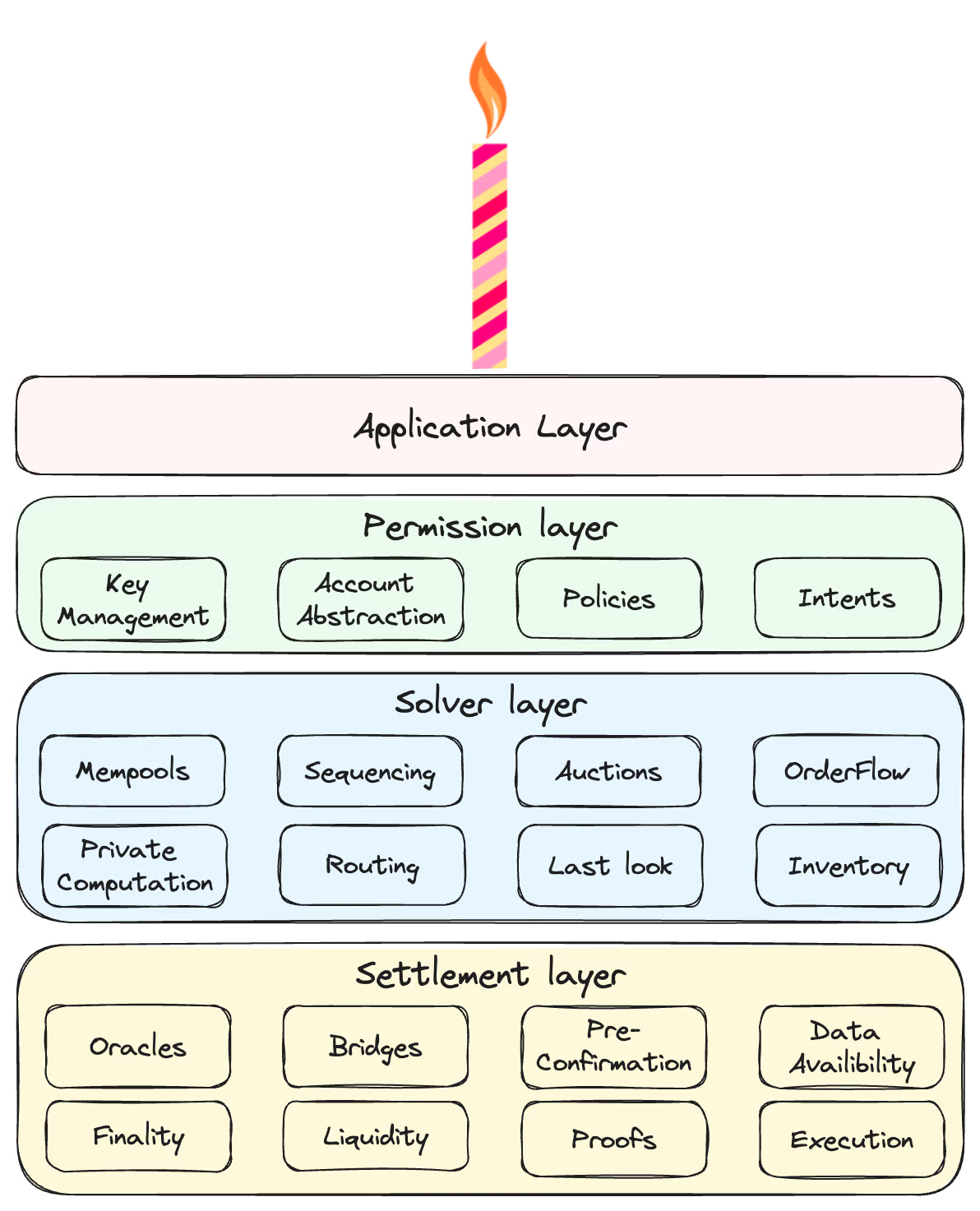

In early 2024, Frontier Research introduced the CAKE Framework, which formalized the components necessary for achieving chain abstraction. This framework identifies three key layers for chain abstraction infrastructure: the Permission Layer, the Solver Layer, and the Settlement Layer. These layers provide the structural foundation for enabling seamless, cross-chain user experiences in apps that reside at the top of the CAKE stack.

The CAKE Framework. Source: Frontier Research

To better analyze these developments, we’ll explore how each of these layers evolved and advanced throughout 2024.

Permission Layer

Source: The RollupCo Chain Abstraction Market Map

Intents: Transforming Transaction Management

Intent-based designs revolutionize transaction management by allowing users to specify desired outcomes rather than executing explicit steps. The emergence of protocols like Across demonstrated the potential of intent-based approaches, which have become essential components of chain abstraction.

The intents-based bridging method, which combines liquidity fronting with solver systems, has since been adopted by nearly every major chain abstraction protocol. This enables near-instant bridging within chain-abstracted apps and accounts, significantly improving user experience. However, risks and operational overhead remain. Protocols like Everclear (for rebalancing) and OneBalance (for managing resource locks) have emerged as complementary solutions, further refining the intent ecosystem.

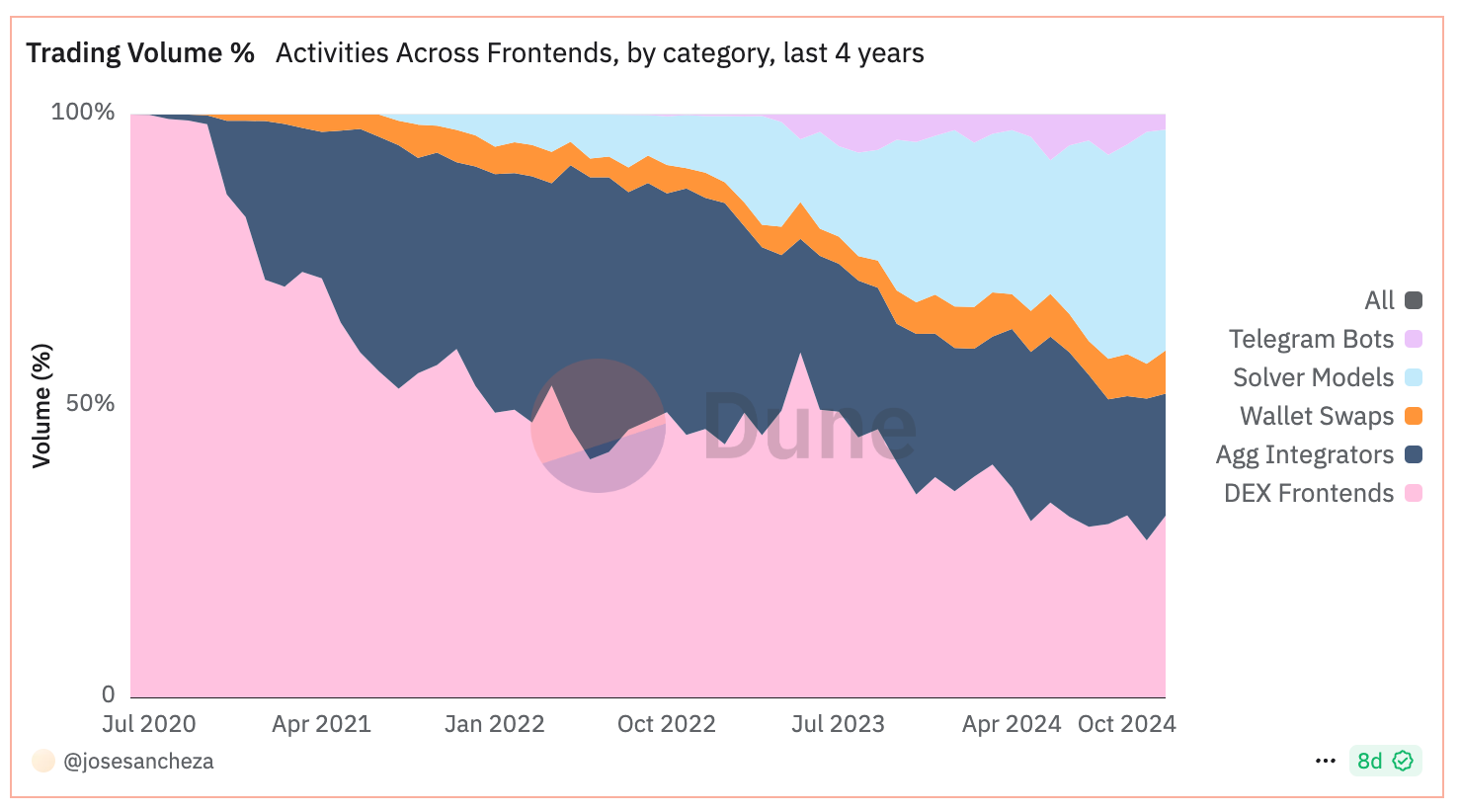

Intents-based bridging (solver models) represents a growing share of trading volumes. Source: @josesancheza (Dune)

Account Abstraction: Addressing Ethereum’s UX Challenges

The fragmented Ethereum user experience has long been a barrier to adoption. Since ERC-4337’s launch in 2023, account abstraction has offered a solution by introducing smart accounts. These accounts support advanced features like batched transactions, merkalized signatures, and resource locks, enabling seamless chain-abstracted experiences.

Innovations in self-custodial wallets have also advanced usability. For instance, Phantom and Privy's email-based onboarding and Telegram’s bot ecosystem have made crypto more accessible, driving broader adoption across both retail and enterprise users.

Universal (Chain-Agnostic) Accounts: The Permission Layer, Materialized

The implementation of the permission layer, particularly through intents and account abstraction, often materializes through solutions understood as “account-level chain abstraction”, in which accounts, often smart accounts, are given the property of balance unification, using intents to automatically bridge funds between chains to meet the condition of a given transaction. Therefore eliminating the need for users of these accounts to maintain explicit knowledge of both the origin and destination chain of their assets; they are intrinsically “chain-agnostic”.

Particle Network is one of a few key builders of this infrastructure, providing Universal Accounts to various apps and wallets. Most recently, Particle Network launched the first live implementation of Universal Accounts, “UniversalX”, a platform in which these accounts are used to allow the buying and selling of tokens on any chain.

Solver Layer

Source: The RollupCo Chain Abstraction Market Map

The Role of Solvers in Intent Execution

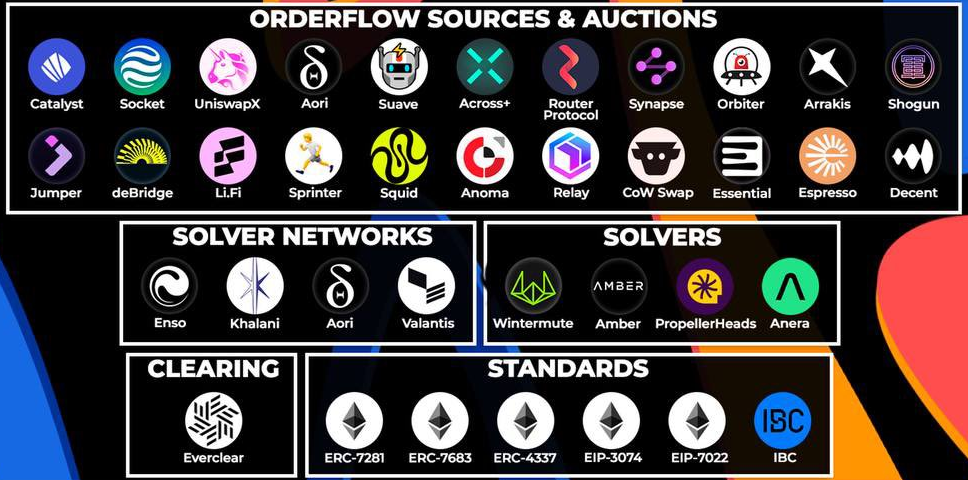

Solvers are integral to most chain abstraction solutions on the market, executing user intents and forming the backbone of transaction processing. In 2024, solvers gained prominence, with 30+ solvers active across intent-based bridges today.

Dynamic Execution and UX Benefits

Intent-based designs have transformed the user experience by simplifying complex cross-chain interactions. Solvers play a pivotal role in enabling users to execute intents seamlessly, handling the intricate details of transaction bundling, batching, and cross-chain execution. By abstracting these complexities, solvers significantly enhance user experience, allowing for faster and more intuitive interactions across applications. This streamlined process reduces friction, making blockchain applications more accessible to users and fostering adoption across diverse ecosystems.

Addressing Key Solver Challenges with Resource Locks and Rebalancing

Maintaining efficient, low-risk solver networks has been a persistent challenge in the evolution of chain abstraction. Resource locks, introduced by OneBalance, provide a critical guarantee of repayment for solvers. By reducing the risks associated with liquidity provisioning, specifically through temporarily escrowing state, these locks enable faster and more reliable transactions, since solvers are no longer subjected to risks such as double spending, ensuring the scalability and sustainability of chain abstraction protocols.

Complementing this, Everclear's clearing layer brings further efficiency through a process known as netting. This mechanism aims to aggregate and offset opposing cross-chain transactions, allowing solvers to settle only the net difference rather than processing each transaction individually. If successfully implemented at scale, netting could minimize the number of on-chain settlements required, reduce gas fees, accelerate transaction times, and enhance capital utilization. While these developments are not yet operational at significant scale, they underscore the potential to streamline operations, alleviate liquidity fragmentation, and bolster the scalability and effectiveness of intent-based protocols in the future.

The Expansion of Multi-Chain Token Standards

A byproduct of so many chains is the introduction of token standards built on interoperability protocols. These standards enable tokens to exist natively on multiple chains, freeing issuers from the hassle of managing wrapped tokens or deciding which chains to launch on. Instead, issuers can start with any number of chains, and later expand to others when it makes sense for their business.

This approach marks a significant improvement over the old method of relying on wrapped tokens to expand to new chains — a method still commonly associated with interoperability protocols. By eliminating liquidity fragmentation across multiple token versions, these standards streamline the user and developer experience for dealing with the tokens that are deployed on multiple chains.

These token standards are seeing impressive adoption. Over $80 billion in value is now secured through them. From institutions like PayPal to DeFi bluechips like Sky, teams are leveraging them to issue tokens and scale across the ecosystem. That said, these token standards come with third-party contagion risk tied to interoperability protocols. If these protocols suffer any hacks, they could impact the projects and tokens that depend on them.

The future likely lies somewhere in the middle. Solvers will use a mix of token standards for managing inventory and rebalancing liquidity. Meanwhile, intent-based protocols, which require verification mechanisms for intents, will continue to use messages sent via interoperability protocols — currently the most prevalent method.

Looking ahead to 2025 and beyond, both intents and token standards will form the backbone of unifying the experience across the crypto ecosystem.

Settlement Layer

Source: The RollupCo Chain Abstraction Market Map

A Proliferation of Settlement Options

As solvers became more integrated into the multichain ecosystem in 2024, new settlement and repayment options emerged. This growing array of choices offers diverse pathways for solvers to demonstrate intent fulfillment, recover funds on source chains, and rebalance liquidity across networks.

Initially designed to support arbitrary message passing for omnichain applications, systems like LayerZero, Wormhole, and ChainLink have evolved into dependable pathways for solvers operating in networks without native interoperability. Emerging solutions, such as Omni, are positioning themselves as dedicated solver infrastructure, providing fast and secure repayment pathways.

Some projects are taking a more user-centric approach by building on chains with shared bridge contracts, allowing liquidity to be shared and composed at an atomic level. This synchronous composability contrasts with the asynchronous nature of solver-based approaches. Interoperability solutions within Optimism’s Superchain, Arbitrum’s Orbit chains, and Polygon’s AggLayer demonstrate this concept, although they remain constrained to ecosystems utilizing the same bridge contract. Similarly, shared sequencing projects such as Espresso, Astria, and NodeKit offer potential pathways for synchronous operations. As more of these projects approach mainnet in 2025, it will be crucial to observe whether asynchronous solver approaches or synchronous composability options dominate.

Standardizing Intents with ERC-7683

The growing adoption of intents-based frameworks has sparked a demand for an open standard for expressing cross-chain intents. ERC-7683, proposed this year by Across and Uniswap, defines the structure of a crosschain intent, acting like an order ticket that anyone can create and any solver can fulfill. This standardization decreases the barrier to entry for solvers and promotes greater competition among them.

Integrating Bridging Processes within Applications

As more applications deployed multichain throughout 2024, there is now a trend towards applications directly integrating liquidity bridges and aggregators directly into their application front ends. For example, LI.FI’s Jumper is a bridge aggregator that has been integrated into numerous applications with the LI.FI SDK and LI.FI widget. Additionally, Uniswap integrated Across directly into its frontend to support cross-chain token swaps. Soon, applications will be able to leverage the Omni SolverNet to access liquidity from Ethereum’s rollup ecosystem without smart contract changes. This movement toward embedding cross-chain value transfers within applications reduces manual effort for users and achieves chain abstraction, allowing users to interact with applications regardless of where their liquidity resides.

Opportunities

The idea of chain abstraction couldn’t have come at a better time. Chain abstraction is the mindset shift the ecosystem needs to move us from an infrastructure-first approach to an application-first one, enabling us to create user experiences that make crypto easy to figure out.

Sure, Bitcoin at $100k is exciting. Ethereum as the backbone of the onchain economy is a big deal. And yes, Solana might be on track to surpass Nasdaq in global significance. But none of this will matter if we can't make the user experience easy — so intuitive that users don’t have to think about chains or where their assets are just to do something simple onchain.

Today, users are bogged down by complexity. Too many chains, too many steps – trying out applications feels overwhelming. Every extra step beyond the norm that a new user has to take is a potential drop-off point. It’s one more chance for someone to throw up their hands and say, “You know what? Forget it.” But chain abstraction can turn all those steps into a one-click experience where users land on the app’s homepage and just start.

When crypto apps feel as intuitive as everyday apps, they stop being "crypto apps" and simply become products people want to use – that’s how crypto goes mainstream.

The implications of chain abstraction run even deeper when applied to developer tooling. If we can eliminate the steep learning curve for building in crypto, often associated with the fragmentation issue, we open the door to a new wave of developers who can dive in and start creating. That’s how we grow the crypto pie — by making it easy for talented people to build cool products without getting bogged down in complexity. The more talent we bring into the space, the faster the ecosystem evolves and chain abstraction unlocks a mindset change that accelerates this process.

Challenges

Like most big ideas, chain abstraction comes with its own set of challenges:

1. Turning Mindshare into Real Usage

Chain abstraction has certainly captured the community’s imagination. But turning narrative momentum into actual users is a whole different challenge. Marketing might build awareness, but real defensibility lies in distribution. And let’s not forget — the hardest part is shipping products that people actually use.

The space is already crowded, with established players and a wave of new protocols that often lack meaningful differentiation in their design. For these players, carving out a niche and attracting users will take more than hype — it will require execution and clear value.

2. Finding the Right Level of Abstraction

Chain abstraction carries an inherent philosophical tension: how much should users even be aware of the underlying chains? Completely hiding chains can improve UX in the short term, but as Vitalik has pointed out, it risks weakening the incentives for chains to prioritize decentralization and security.

Chain abstraction protocols face the tricky task of balancing UX with transparency. On one hand, users who prioritize security need clear visibility into which chains their assets are stored on. On the other, many users will value simplicity above all else. The deeper challenge lies in ensuring that default choices — like where assets are stored — strike the right balance between security and convenience, catering to both ends of the spectrum.

3. Avoiding Walled Gardens

One of the biggest promises of chain abstraction is improved onboarding. But if every app using these protocols forces users into app-specific wallets, we’re back where we started: fragmented accounts and walled gardens. For example, a user shouldn’t need one account for Infinex, another for Jumper, and yet another for UniversalX.

For chain abstraction to truly deliver, users must be able to link accounts seamlessly across all applications while maintaining composability with the broader ecosystem. Anything less undermines the very principles that abstraction aims to uphold.

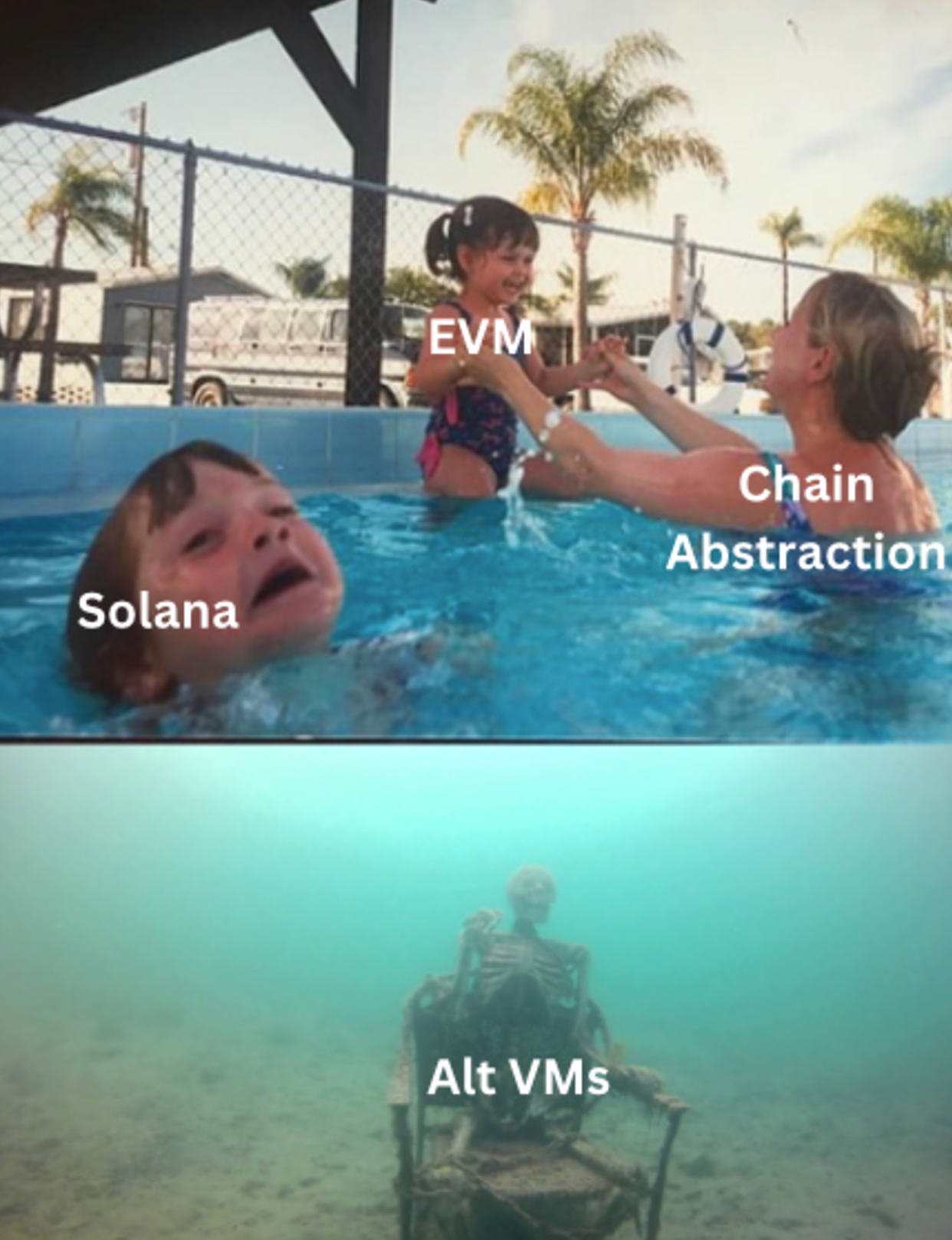

4. Building Abstractions for All of Crypto

Most chain abstraction protocols today are heavily centered on Ethereum and EVM- chains, with occasional support for Solana or native Bitcoin. That focus makes sense—they’re targeting where the demand currently is. But as the ecosystem expands and alternative VMs proliferate, these protocols will need to scale beyond their current scope.

At the moment, chain abstraction is largely focused on the EVM ecosystem.

Chain abstraction protocols will need to keep pace with the alt VM ecosystem and adapt to support a growing variety of chains, regardless of their virtual machine. This won’t be easy. Chain abstraction relies on a complex stack of underlying infrastructure — intents, solvers, interoperability protocols, oracles, and more. For abstraction to scale effectively, all these components need to evolve in sync, which is no small feat.

5. Securing the Abstraction Layers Themselves

Like any complex system, chain abstraction protocols are vulnerable to exploits, with one of the most critical risks being signature verification and proof validation. Currently, most chain abstraction protocols are still in development, and there’s been little to no discussion around security models. However, as more protocols go live, this part of the stack will require increased scrutiny and careful design to effectively mitigate these risks.

Conclusion

2024 was a defining year for chain abstraction. The concepts of Permission, Solver, and Settlement layers have moved from theory to implementation, laying the groundwork for a more interconnected and user-friendly blockchain ecosystem. While challenges remain, the progress made this year provides a strong foundation for the continued evolution of chain abstraction in 2025 and beyond.